< Key Hightlight >

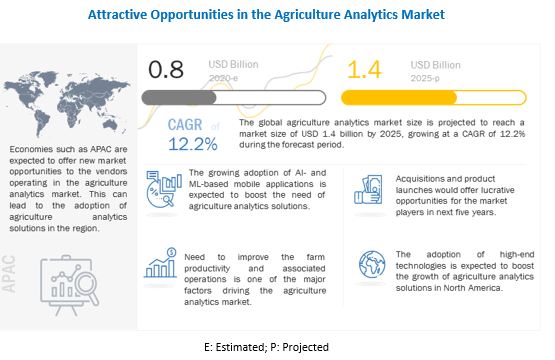

[249 Pages Report] The global agriculture analytics market size is expected to grow from USD 0.8 billion in 2020 to USD 1.4 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 12.2% during the forecast period. Growing trend of digitization and risk assessment, and unlock the potential of urban farming is also expected to drive the market growth. However, high cost of gathering precise field datais one of the factors hindering the industry growth.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the global agriculture analytics market

The COVID-19 pandemic had a significant global impact, due to which several industries are facing dire consequences. The agricultural and related industries have been severely impacted by the situation, owing to lockdown, trade barriers, and decline in import-export of goods.

As incidences of COVID-19 increase in countries around the world, disruptions to agri-food supply chains are faced by many countries. According to a report published by FAO, Africa is one of the most vulnerable countries. The majority of Africa depends on the import of food, even for the fulfillment of domestic demand. The import includes cereals, grains, pulses, fruits, vegetables, and even meat. The national trade barriers between countries might have a drastic effect on regions such as Africa who rely heavily on agricultural imports. Usually, the food sector is supplied by three sources; domestic production, imports, and storage. Some countries also rely on a network of manufacturers and distributors to process agricultural outputs, prepare them for human consumption, and move products from farms, to production facilities, and finally to consumers. Although there may have been plenty of food within the supply chains at the start of the crisis, disruptions to food supplies have tracked outbreaks due to a rise in panic buying by people concerned about food supplies during potential lockdowns. If outbreaks around the world are severe or continue over a long period of time, there are likely to be even more serious disruptions that may reduce food availability in the markets over the medium and longer terms.

Market Dynamics

Driver: Unlock the Potential of Urban Farming

Urban agriculture, both in terms of people growing food in community plots or in rooftop gardens, has become a popular trend around the world in recent decades. While the ability to provide locally-grown crops to urban populations shouldn’t be discounted, there are many benefits to urban farming that go beyond simply providing food to local communities. There is a positive environmental impact in terms of reducing runoff from heavy rainfall and improving air quality. The work that must go into planting and maintaining these plots also helps to strengthen the community’s social bonds.

Armed with big data analysis and AI, urban farmers can improve efficiency and maximize the potential of the limited space available to them. Some researchers believe that those efforts could ultimately produce as much as 180 million metric tons of food each year, representing about ten percent of the global output of legumes, roots and tubers, and vegetable crops..

Restraint: High cost of gathering precise field data

The major restraining factor for the AI in agricultural market is the high cost of gathering precise field data. AI technology requires high initial investments, efficient farming tools, and skilled and knowledgeable farmers or growers, among others, thereby making the farmers apprehensive about using this technology for gathering precise field data. Farmers or growers must make huge investments in GPS, drones, and GIS to collect input data for variable rate application technology from satellites and other GPS devices. AIbased farming is costly, as it involves data acquisition for geospatial data (for efficient input selection) and training for data management, among others. The GPS technology-enabled devices, such as drones and driverless tractors for navigation and mapping applications, are expensive and require high initial investments.

Opportunity: Growing Adoption of Big Data IoT Sensors Transforming Livestock Care

Illnesses can spread quickly in a herd of hundreds or thousands of cows. In many instances, the sicknesses contracted by a few cows spread to dozens of others before farmers realize the problem. Thankfully, several IoT gadgets exist to prevent that issue and others. Some of them monitor fertility, which could be specifically advantageous on properties where farmers depend heavily on successful breeding. Others notify farmers when cows are in periods of high milk production. Based on what the data says, farmworkers can do things like adding a type of grain that promotes lactation to an animal's feeding regimen.

Sensors collect data about behavioral abnormalities, too. Since those variations could be the first sign of a severe illness, the information helps farmers be proactive in curbing possible health issues by isolating cows that may be ill. Since these sensors typically receive data continually and could be used on farms with thousands of cows, it's easy to understand why data centers are instrumental in helping agriculture professionals collect and retrieve information.

Big data are expected to have a large impact on smart farming and involves in every stage of food supply chain. Smart devices such as sensors, and GPS/GNSS produces large amount of data with unprecedented decision-making capabilities. As more and more smart devices and sensors are installed on the farms, agriculture practices will become increasingly data driven and data-enabled. Big data is expected to cause major shifts in transforming agriculture industry. New technologies such as IoT and cloud computing are expected to leverage this development and introduce more robots and artificial intelligence in farming.

Challenge: Technological awareness among farmers

A lack of technological awareness is one of the major restraining factors for the adoption of digital agriculture, especially in developing countries. There are some basic conditions that must exist for the use of digital technologies and, therefore for the digital transformation of the agriculture and food sector. These include literacy to use technology, infrastructure & connectivity, network coverage, internet access, and affordability. Developing countries like India, and China, offers a vast market for digital agriculture but the lack of awareness, especially among the small rural farmers, is a hindering factor.

This lack of technological awareness also hinders farmers from investing and modernizing their practices of production. They often face a tight economic situation with very limited investment ability in new production tools and limited access to credit. Even the investment in digital agriculture technologies poses a threat to small landholding farmers. The government can play an important role in lending a helping hand to mitigate the risk and increase the adoption of digital agriculture. For instance, The US has long had major government programs in place to facilitate risk management for farmers in various forms. The bulk of funding is allocated to risk management and insurance programs with great success. The Bulgarian government had also come across many agricultural reforms, where the farmers are getting financial help to buy advanced field equipment and regional technology service providers who offer associated products and services. The companies in Bulgaria also provide a software engineer or a technician who provides technical assistance to the farmers to make them aware of technology involved and how to use it.

The engagement of digital agriculture requires knowledgeable and skilled farm managers and laborers, as well as a cadre of well-educated consultants and service providers. Most educational institutions are inadequate in offering such infrastructure, and professional talent tends to favor urban over the rural living. This COVID-19 pandemic had shown the importance of digital agriculture and the role of government for its facilitation.

The livestock analytics application area is expected to grow at the fastest CAGR rate during the forecast period

The livestock analytics application area includes feeding management, heat stress management milk harvesting, breed management, behavior monitoring and management, and others. Where, others includes calf management, genetic management, and cattle sorting. The livestock agriculture includes varied task performed daily, which generate large volumes of critical data about the animal. Any, miss- management in the diet or tracking of the animals can cause major loss to the farmers. Hence, farmers are investing toward analytics solutions that help them in managing their livestock process for quality production.

By component type, the solution segment is expected to hold the largest share during the forecast period

The growing need for agribusiness to effectively analyse critical farm related data for better decision making is contributing to the growth of the agricultural analytics solution segment. Crop yield depends on multiple factors such as weather parameters, soil condition, fertilizer application, and seed variety. It becomes very challenging for farmers to identify the critical factors from large data sets that can impact their farm productivity. Agriculture analytics solution allows to corealte wide variety of data to get valuable insight for increasing productivity.

The large farms segment is estimated to account for a larger market size during the forecast period

The adoption of agriculture analytics solution in large enterprises is higher than the small and medium-sized farms, owing to the affordability and high economies of scale. The increasing competitive landscape and need to meet the global food requirements enforce them to turn to agriculture analytics solution and service to enhance the usage of resources for better production. Large farm size performs high-level business operations that generate huge volumes of information. Agriculture analytics service providers help large enterprises to effectively manage and utilise the information for maximum output.

North America is expected to account for the largest market size during the forecast period

North America is expected to hold the largest market size and dominate the agriculture analytics market from 2020 to 2025. The region majorly has large farms with best in class farming equipment’s, which largely contribute to the growth of the agriculture analytics market. APAC is expected to provide lucrative opportunities for the agriculture analytics vendors, owing to the increasing investments in the digital agriculture practices and implementation of cloud-based solutions among growers in the region. However, lack of standardization for data in various regions could affect the adoption of agriculture analytics solution

Key Market Players

The agriculture analytics platform vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions, to strengthen their offerings in the market. The major vendors offering Agriculture analytics solutions are Deere & Company (US), IBM (US), SAP SE (Germany), Trimble (US), Monsanto (US), Oracle (US), Accenture (Ireland), Iteris (US), Taranis (Israel), Agribotix (US), Agrivi (UK), DTN (US), aWhere (US), Conservis Corporation (US), DeLaval (Sweden), FBN (US), Farmers Edge (US), GEOSYS (US), Granular (US), Gro Intelligence (US), Proagrica (UK), PrecisionHawk (US), RESSON (Canada), Stesalit Systems (India), AgVue Technologies (US), Fasal (India), AGEYE Technologies (US), HelioPas AI (Baden-Württemberg), OneSoil (Belarus), and Root AI (US).

Scope of the report

Report Metric | Details |

Market Size Available for years | 2014-2025 |

Base year considered | 2019 |

Forecast Period | 2020-2025 |

Forecast units | Value (USD Billion) |

Segments covered | Application Area, Component, Farm Size, Deployment Mode, and Region |

Geographies covered | North America, APAC, Europe, MEA and Latin America |

Companies covered | The major market players include Deere & Company (US), IBM (US), SAP SE (Germany), Trimble (US), Monsanto (US), Oracle (US), Accenture (Ireland), Iteris (US), Taranis (Israel), Agribotix (US), Agrivi (UK), DTN (US), aWhere (US), Conservis Corporation (US), DeLaval (Sweden), FBN (US), Farmers Edge (US), GEOSYS (US), Granular (US), Gro Intelligence (US), Proagrica (UK), PrecisionHawk (US), RESSON (Canada), Stesalit Systems (India), AgVue Technologies (US), Fasal (India), AGEYE Technologies (US), HelioPas AI (Baden-Württemberg), OneSoil (Belarus), and Root AI (US) (Total 31 companies) |

The study categorizes the agriculture analytics market based on component, deployment mode, farm size, application areas at the regional and global level.

On the basis of component, the agriculture analytics market has been segmented as follows:

On the basis of application areas, the market has been segmented as follows:

- Farm analytics

- Livestock analytics

- Aquaculture analytics

- Others (Orchid, Forestry, and Horticulture)

On the basis of farm size, the agriculture analytics market has been segmented as follows:

- Large Farms

- Small and Medium-Sized Farms

On the basis of deployment modes, the market has been segmented as follows:

On the basis of regions, the agriculture analytics market has been segmented as follows:

- North America

- Europe

- APAC

- Australia and New Zealand (ANZ)

- China

- Rest of APAC

- MEA

- Kingdom of Saudi Arabia (KSA)

- South Africa

- Rest of MEA

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In April 2020, IBM released novel AI-powered technologies to help the health and research community accelerate the discovery of medical insights and treatments for COVID-19.

- In April 2020, SAP established COVID-19 Emergency Fund (USD 3.4 million) to support the urgent needs of the World Health Organization (WHO), Centers for Disease Control and Prevention (CDC) Foundation, and smaller nonprofits and social enterprises. These organizations work on the front lines to cater to local communities in crisis.

- In June 2020 2019, SAP has launched the German government’s Corona Warn App. The app was developed in collaboration between SAP and Deutsche Telekom as well as other partners. It was developed in open-source mode, and the program code was continuously visible to the public on the development platform GitHub.

- In April 2019, Trimble launched a new entry-level Trimble Ag Software subscription called Farmer Core. It enables farmers to connect all aspects of their farm operations.

- In February 2019, Deere & Company announced updates to its 19-1 software to enhance the automation, documentation, functionality, and security of Generation 4 4600. This latest software has a higher level of automation activation, which has enabled the company’s Machine Sync harvest automation functionality on the Gen 4 platform for tractors.