< Key Hightlight >

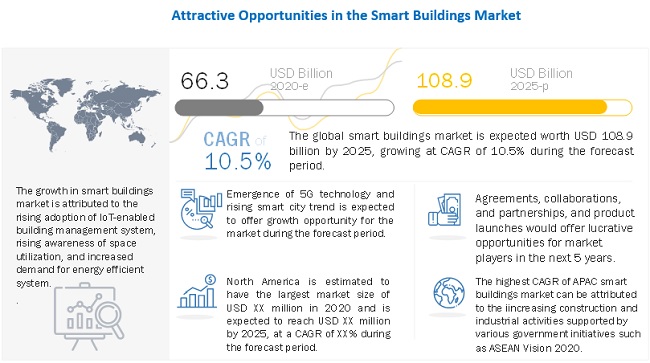

[249 Pages Report] The Smart buildings market is projected to grow from from USD 66.3 billion in 2020 to USD 108.9 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 10.5% during the forecast period. The major drivers for the Smart building include rising adoption of IoT-enabled building management system, rising awareness of space utilization, increased industry standards and regulations, and increase demand for energy efficient system.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the global smart buildings market

The outbreak of COVID-19 has adversely affected the North American economy. However, the region has begun easing restrictions and lifting lockdown measures to restart the economy. As North America is a technologically advanced region, facility managers can optimize their jobs and create a better environment for facility occupants. There has been an upsurge in the demand for smart building to integrate new office environments as employees are working from home.

Some of the prominent industries in Europe, such as automotive, chemical, electronics, and manufacturing, have been affected drastically due to the disruption of the supply chain during the COVID-19 lockdown. Now, as European countries have started relaxing restrictions for commercial premises and industries, there is an increased demand for smart building solutions and services. With the help of technologies such as AI, blockchain, robots, and drones, smart building vendors are trying to bring industries and businesses back to normalcy.

The smart building market in APAC is expected to increase during COVID-19 due to the rising trend of hospitals outsourcing non-core medical services to professional smart building organizations. IoT and other new technologies are driving the current smart building market in healthcare. Moreover, as organizations are preparing for reopening, there is an increased focus on new services and activities in the region to facilitate employees’ return to their workplace.

Iran and Israel have been the most affected by COVID-19 in MEA. Governments in the region have rapidly taken decisive measures to slow down the impacts of the pandemic. Due to the easing of restrictions in the region, almost all industries and companies in the region are reopening. Therefore, there could be an increased demand for smart building vendors to reorganize the workplace, set up smart workflows, and manage facilities in a proactive manner.

COVID-19 has affected the healthcare and energy industries in Latin America. However, these industries are trying to adopt emerging technologies such as AI and IoT to overcome COVID-19 related challenges. As countries in the region are reopening their industrial operations, there could be an upsurge in the demand for smart building solutions and services. Technology-driven efficiency could elevate commercial outcomes in the region, resulting in holistic and empowered smart building operations. Moreover, current assets in the region need to be upgraded in a cost-effective way, and IoT, AI, and ML-enabled smart building is the best fit. Therefore, the reopening of businesses is giving rise to more opportunities for smart building vendors.

Market Dynamics

Driver: Rising adoption of IoT-enabled building management system

IoT has a significant impact on the Commercial Real Estate (CRE) industry owing to a growth in the efficiency of building operations, improved tenant relationships, and new revenue generation opportunities. IoT-enabled BMS is installed and used for increasing building performance efficiency and using sensor-generated data to enhance building user experience. It can also leverage a single infrastructure to operate all building management solutions and require minimum to no manual interventions. Furthermore, IoT-enabled BMS can be used for various purposes, such as reducing energy use, repairing and maintaining building systems, and cutting down administrative costs of the building. For instance, property owners use the data collected from various sensors, such as indoor-air quality and space utilization at the building level to regulate air-conditioning and lighting systems in real time, thereby reducing energy costs and optimizing the internal environment for its intended purpose. The IoT technology provides owners with an opportunity to have direct conversations and relationships with building users along with their tenants. For instance, sensors in shopping malls can help owners connect directly to various customer and provide their services, resulting into building relationships with customers and strengthening tenant engagement. Hence, IoT-enabled BMS is driving the smart buildings market.

Restraint: Lack of cooperation among standard bodies

Great cooperation is required among standard bodies, corporations, city governments, and other stakeholders for IoT and existing smart-building technologies to work together. This cooperation in the building of smart cities is vital in bringing out the maximum potential of these technologies. Moreover, the various layers of building management, such as property and tenant management and facility management, have their own requirements and operating systems, which are not necessarily designed for integration with other systems, making it difficult for obtaining information from the building systems.

Opportunity: Emergence of 5G technology

The introduction of 5G technology enhances new and powerful intelligent building capabilities and plays a pivotal role in the expansion of IoT-enabled devices by providing efficient real-time operational and analytic capabilities. A huge amount of data is generated owing to IoT-enabled devices in smart buildings, however 5G technology enables quick building data transport, interpretation, and efficient actions taken in an economical manner. 5G significantly enhances the user/occupant’s experience, while providing many other creative and useful Building Internet of Things (BIoT) and AI-enabled innovations.

Challenges: Rising privacy and security concerns owing to IoT-enabled devices

A large number of buildings are integrating smart technology with their designs and operations. The adoption of technologies, such as IoT and sensors offers tenants and landlords tremendous convenience. However, the adoption of these technologies poses a security threat to the building. Most IoT devices and sensors have a weak security built-in, use non-standard communication protocols, and are operated by old, unpatched software, which could expose smart buildings to various vulnerabilities. Furthermore, hackers always scan targets for technological weaknesses to infiltrate into a particular network and steal valuable data or take control of a facility. For instance, cybercriminals infiltrate the Business Activity Statement (BAS) in order to stop the working of passenger lifts, gain access to security feeds from Closed-Circuit Televisions (CCTVs), and disrupt power supplies to the entire building or parts of it. Moreover, a well-planned cyberattack involving readily-available IoT devices and sensors in any smart building could potentially expose sensitive data storage, servers, and employee and customer information, which could be used for malicious purposes. Thus, rising privacy and security concerns owing to the adoption of IoT-enabled devices poses a restraint to the smart buildings market.

Based on solution type, energy management segment of the Smart buildings market is projected to grow at the highest CAGR during the forecast period.

Based on the solution type, the energy management segment of the market is projected to grow at the highest CAGR from 2020 to 2025. As energy management solutions for smart building help to reduce and monitor the energy consumption of the building. Moreover, keeping operational expenses low is a continuous challenge for owners and managers of multistory buildings, schools, or building complexes which can achieved through smart building energy management solution.

Based on building type , the commercial segment is expected to lead the Smart buildings market in 2020.

Based on building type, the commercial segment is projected to lead the smart buildings market from 2020 to 2025. The growth of this segment can be attributed to need for appropriate and tailor-made solutions for optimized energy performance to reduce building energy consumption without compromising comfort or security and enhancing energy performance of the commercial buildings as these buildings consume higher energy and also generate more waste in the form of carbon and other solid wastes.

The North American region is expected to lead the Smart buildings market in 2020.

The North American region is expected to lead the Smart buildings market in 2020. North America is one of the most developed countries in terms of technology. The growth of the market in North America can be attributed to emergence of latest smart building solutions that leverage new technologies, such as IoT, big data, cloud computing, data analytics, deep learning, and artificial intelligence, for saving energy, reducing operational expenditures, increasing occupancy comfort, and meeting increasingly stringent global regulations and sustainability standards. Moreover, the US and Canada are prominent countries contributing to technological development in this region; for instance, US organizations are heavily investing into smart building measures, such as building controls and building systems integration, to leverage energy efficiency and energy storage and deliver smarter, safer, and more sustainable buildings while the Canadian government is taking initiatives to support Canada's commitment to protecting the environment and its resources by making federal buildings more energy efficient and reducing greenhouse gas emissions, driving the growth of smart buildings

Key Market Players

Key market players profiled in this report include 75F (US), ABB (Switzerland), Aquicore (US), Bosch (US), BuildingIQ (US), Cisco (US), CopperTree Analytics (Canada), ENTOUCH (US), Hitachi (Japan), Honeywell (US), Huawei (China), IBM (US), Igor (US), Intel (US), Johnson Controls (Ireland), KMC Controls (US), Legrand (France), Mode:Green (US), PTC (US), Schneider Electric (Germany), Siemens (Germany), Softdel (US), Spaceti (Czechia), Telit (UK), and Verdigris Technologies (US). These players have adopted various growth strategies such as partnerships, business expansions, agreements, and collaborations; and new product launches and product enhancements to further expand their presence in the Smart buildings market and broaden their customer base.

Scope of the Report

Report Metric | Details |

Market size available for years | 2017-2025 |

Base year considered | 2019 |

Forecast period | 2020-2025 |

Forecast units | Value (USD) Million |

Segments covered | Component (solutions and Services), building type, and Region |

Geographies covered | North America, Europe, APAC, Latin America, and MEA |

Companies covered | The vendors covered in the Smart buildings market include 75F (US), ABB (Switzerland), Aquicore (US), Bosch (US), BuildingIQ (US), Cisco (US), CopperTree Analytics (Canada), ENTOUCH (US), Hitachi (Japan), Honeywell (US), Huawei (China), IBM (US), Igor (US), Intel (US), Johnson Controls (Ireland), KMC Controls (US), Legrand (France), Mode:Green (US), PTC (US), Schneider Electric (Germany), Siemens (Germany), Softdel (US), Spaceti (Czechia), Telit (UK), and Verdigris Technologies (US) |

The research report categorizes the smart buildings market to forecast the revenues and analyze trends in each of the following subsegments:

By Component

- Solutions

- Building infrastructure Management

- Parking Management System

- Smart Water Management System

- Elevators and Escalators Management System

- Security and Emergency Management

- Access Control System

- Video Surveillance System

- Safety System

- Energy Management

- HVAC Control System

- Lighting System

- Network Management

- IWMS

- Services

- Consulting

- Implementation

- Support and Maintenance

By Building Type

- Residential

- Commercial

- Industrial

By Region

- North America

- Europe

- APAC

- China

- Japan

- Australia

- Rest of APAC

- MEA

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In August 2019, Cisco completed the acquisition of Sentryo, a provider of device visibility and security solutions for Industrial Control System (ICS) networks. This acquisition enables Cisco to offer control system s engineers deeper visibility into assets for optimizing, detecting anomalies, and securing their networks.to optimize, detect anomalies and secure their networks.

- In January 2019, Adesto Technologies Corporation demonstrated predictive energy analytics for smart buildings with the help of the IBM’s Watson IoT platform. Through this partnership Adesto is enabling smarter buildings by gaining insights through insights into energy management and other operational data through via services running on the IBM Watson IoT platform.

- In May 2019 ,Hitachi Vantara, a wholly owned subsidiary of Hitachi, launched Lumada Video Insights, an end-to-end, intelligent, and adaptable suite of applications that delivers operational safety and business intelligence BI using IoT, video, artificial intelligence (AI), and analytics. This solution enhances the Lumada platform and services ecosystem with its advanced AI, computer vision, advanced analytics, data integration, and orchestration capabilities to help which helps enterprise and industrial customers to accelerate their IoT initiatives and cultivate their own smart spaces and ecosystems.

- In July 2019, Hitachi elevators uses AI, and IoT to develop a smart building ecosystem in which the where the company aims to provide a wide range of buildings with custom-designed, multi-directional, in-building transportation solutions.

- Siemens acquired Enlightened, a Silicon Valley-based provider of IoT systems for commercial and residential buildings. Enlightened’s IoT platform helps to reduce the energy used by buildings’ energy use and improves space utilization.