< Key Hightlight >

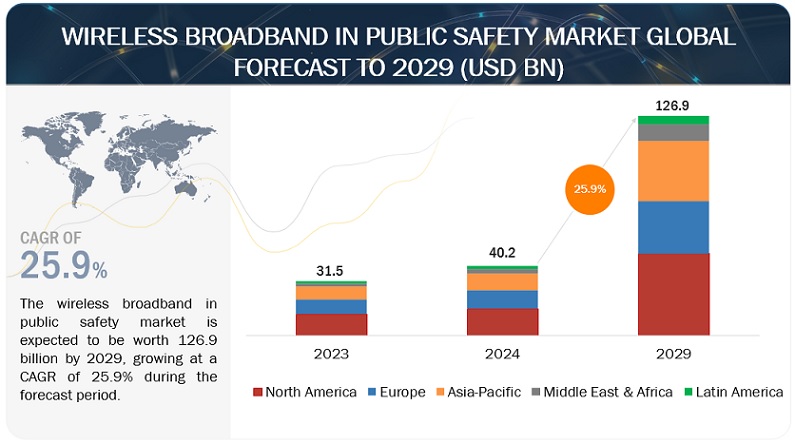

[202 Pages Report] The post-COVID 19 wireless broadband in public safety market size to grow from USD 20.6 billion in 2021 to USD 69.6 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 27.6% from 2021 to 2026.

The major factors fueling the Wireless Broadband in Public Safety market include Mobility growth and increase in mobile connectivity, enhancement in public safety and availability of real-time information and big investments in wireless broadband to boost the growth of wireless broadband in public safety market across the globe during the forecast period. Moreover, enhancing next-generation technologies and availability of wireless broadband in rural areas would provide lucrative opportunities for Wireless Broadband in Public Safety vendors.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID 19 Impact

The COVID-19 pandemic has sharply boosted user activity for many entertainment and streaming services, causing plunging advertising at some companies. Since the starting of COVID-19, in the US, broadband traffic have increased significantly. US broadband networks accommodated this higher demand, in part because US network speeds were already faster than many peer nations. COVID-19 has created a new normal that has millions of people consuming dramatically more network bandwidth than ever before. For example, according to Vodafone, it has seen 50% increase in European internet usage in recent times, while Netflix had been requested to cut its bitrate in Europe for 30 days to prevent the internet from collapsing. Due to the pandemic, overall use of broadband and penetration of wireless broadband in rural areas have significantly increased. The sudden increase in the usage of broadband services in rural areas will have a direct impact on the wireless broadband in public safety market.

Market Dynamics

Driver: Mobility growth and increase in mobile connectivity driving the growth of wireless broadband in public safety market

One of the main reasons behind the growth of wireless broadband is the surge in the usage of mobile phones. People have started using the internet for various safety and essential reasons. According to the Mobile Economy Report 2019, about 5.2 billion people subscribed to mobile services, accounting for 67% of the global population. Cisco predicted that more than 70 percent of the global population would have mobile connectivity by 2023. Cisco has also predicted the total number of global mobile subscribers to reach approximately 71% of the population by 2023. In terms of mobility growth, the fastest-growing mobile device category is M2M, followed by smartphones. A surge in active social media users, internet users, and mobile phone users is also expected to have a positive impact on the usage rate of wireless broadband for public safety reasons.

Restraint: Security breaches and interception

Wireless communications are prone to interception and security breaches despite advances in wireless security protocols and encryption techniques for overall public safety. The complexity in ensuring security in commercial Wi-Fi networks and public areas is a major concern. For example, during evacuation and rescue, first responders and data center operators constantly exchange sensitive data and information. Any interception of their communication will enable the intruder to access the sensitive information and hamper their ongoing rescue and management efforts, too. According to recent research by Probrand, about 43% of UK businesses have reported security breaches in the last 12 months. Furthermore, in 2018, a report published by Broadband Genie showed that 54% of British people having broadband connections were worried about their router getting hacked

Opportunity: Enhancing next-generation technologies and availability of wireless broadband in rural areas

The enhancement of next-generation technology is of utmost necessity for all regions, especially during post-pandemic times. Since the outbreak, many enterprises have changed their working strategy, and many employees took this opportunity to leave big cities for more rural destinations. This presents a significant economic opportunity for rural communities, but only in those areas that can offer the residents access to robust broadband internet. According to a recent study by satellite.com, 67% of employees stated that internet availability affects their decision, and 36% said a lack of access to broadband internet is preventing them from making a move. High-speed internet will be a game-changer for the rural economies towards safety since an increase in broadband usage will increase the adoption rate of public safety applications. According to FCC’s broadband progress report, 19 million Americans still do not have access to wireless broadband. This creates a scope of opportunities for countries across various regions to expand wireless broadband to rural areas to increase usage of the internet for various public safety purposes.

Challenge: Access to 5G wireless spectrum and handling of data demand

Wireless carriers still need to bid for the higher spectrum bands as they build and roll out their respective 5G networks. Countries, such as Canada, have some of the fastest 4G networks in the world, with the existence of three national operators, including Telus, Bell, and Rogers. 5G network is more challenging because Canada’s operators have had access to less new 5G wireless spectrum than operators in many other countries. Furthermore, in the US, T-Mobile observed an 87% surge in the usage of video conferencing applications, such as Zoom, Slack, and Webex; a 60% surge in mobile hotspot usage; and an 85% surge in video game traffic since the beginning home stay orders. This increase in application usage set off alarms for some CSP networks, raising questions about their ability to handle an avalanche of data demand.

To know about the assumptions considered for the study, download the pdf brochure

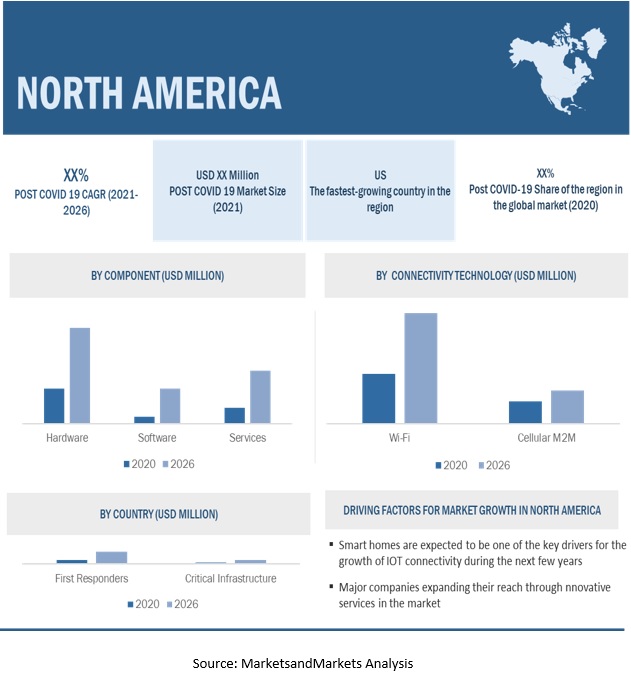

North America to hold the largest market size during the forecast period

The wireless broadband in public safety market in North America is expected to be the highest revenue contributor during the forecast period. The region accounted for the largest share of the overall wireless broadband in public safety market in 2014. Major countries in this region are the US, Mexico, and Canada. Post 9/11, government officials in North America have been taking major steps for improving public safety by investing in wireless broadband technologies. Several initiatives are taken for the growth of wireless spectrums, signifying a wide pool of opportunities in the interoperable wireless network for public safety. In terms of population, the P25 technology is widely employed in North America due to its technical specifications, despite the extensive use of TETRA in RoW. The wide area coverage and greater range of P25 make it the preferred choice in the US markets.

Public safety departments in North America are stringent when it comes to the implementation of critical communication solutions on airports, ports, roads, railways, and metros. Governments in this region have formulated various authorities to set up critical communication networks and network protocols, such as FirstNet and Next Generation 911 (NG911), respectively.

Key Market Players

Major vendors in the global Wireless Broadband in Public Safety market include Aruba Networks(US), AT&T(US), Broadcom(US), Cisco(US), Ericsson(Sweden), Extreme Networks(US), Hitachi(Japan), Juniper Networks(US), Motorola Solutions(US), Huawei(China), NEC(Japan), Netgear(US), Sierra Wireless(Canada), Verizon(US), ZTE(China), General Dynamics(US), Harris(US), Bittium(Finland), Hughes(US)

Aruba Networks is one of the leading providers of a wide array of technologies. Aruba Networks, an HPE company, is a worldwide provider of enterprise mobile solutions and services. The company offers APs, network configuration solutions, wireless controllers, and other wireless products and services. The company follows 802.11n and 802.11ac standards to deliver wireless products and services. It vastly depends upon the revenue generated by the wireless services segment. The company is increasing its market leadership by launching new products and services, such as the Aruba Instant Enterprise software, which delivers the industry’s first controller-less networking solution for enterprises. The expansion of new WLAN solutions and Wi-Fi solutions has offered a wide range of services for existing and new customers. The company offers a broad portfolio of products and services for WLAN, remote networking, wired access, outdoor mesh, access management, and network management. Aruba Networks has focused its product portfolio on network infrastructure, access management, and mobility applications.

Scope of Report:

Report Metric | Details |

Market Size available for years | 2017-2026 |

Base Year Considered | 2020 |

Forecast period | 2021-2026 |

Forecast Unit | Value(USD) |

Segments covered | Wireless Broadband in Public Safety Market:

Technology, Offering, Application, End User |

Geographies covered | - North America

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific (RoAPAC)

- Rest of World

|

Companies Covered | Aruba Networks(US), AT&T(US), Broadcom(US), Cisco(US), Ericsson(Sweden), Extreme Networks(US), Hitachi(Japan), Juniper Networks(US), Motorola Solutions(US), Huawei(China), NEC(Japan), Netgear(US), Sierra Wireless(Canada), Verizon(US), ZTE(China), General Dynamics(US), Harris(US), Bittium(Finland), Hughes(US), Cambium Networks(US), Infinet Wireless(The Netherland), Nettronics Networks(Canada), Proxim Wireless(US), Radwin(Israel), Redline Comminication(Canada), Teltronic(Spain), Case Emergency Systems(US), Prallel Wireless (US) |

The research report categorizes the market into the following segments and subsegments:

Wireless Broadband in Public Safety Market, By Technology

Wireless Broadband in Public Safety Market, By Offering

- Hardware

- Wireless Adapter

- Access Point and Range Extender

- Other Offerings

- Software Solutions

- Services

- Managed Services

- Professional Services

Wireless Broadband in Public Safety Market, By Application

- Critical Communication

- Remote Monitoring and Surveillance

- Location Guidance

- Others

Wireless Broadband in Public Safety Market, By End User

- First Responders

- Fire Fighters

- Law Enforcement

- Other First Responders

- Critical Infrastructures

- Commercial Facilites

- Healthcare and Medical Facilities

- Government Facilities

- Transportation System Sector

- Other Critical Infrastructures

Wireless Broadband in Public Safety Market, by Region

- North America North America

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific (RoAPAC)

- Rest of the World

Recent Developments

- In December 2020, Aruba Networks launched a new product called Aruba CX8360.

- In October 2020, Comcast Business partnered with Aruba on a new VPN service for remote workers. Companies said the Comcast Business Teleworker VPN is meant to help enterprises adapt to an expanding remote workforce during the COVID-19 pandemic.