< Key Hightlight >

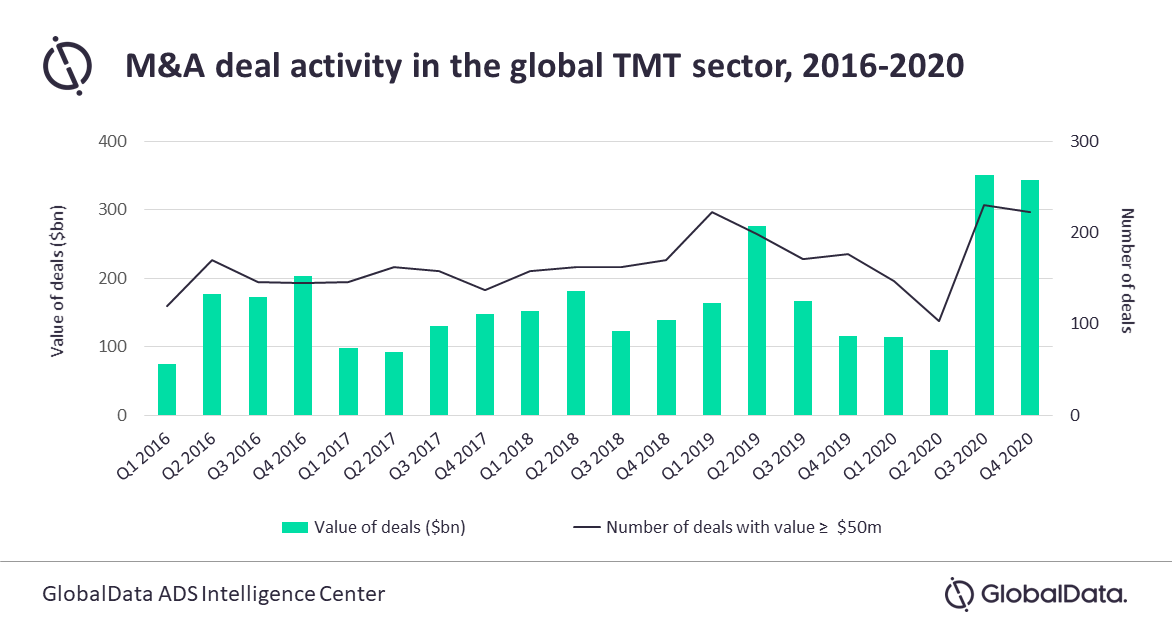

Merger and acquisition (M&A) activity in the tech, media, and telecom (TMT) market bounced back from the impact of COVID-19 in 2020 to achieve nearly $1 trillion in transaction value. Q2 2020 saw just 103 M&A deals in the sector – the lowest quarterly deal count in the last five years – but volume rebounded to 230 in Q3 and 222 in Q4, making the second half of the year the highest in terms of both deal count and deal value in the last five years.

GlobalData expects M&A activity to continue at such a high level throughout 2021 as companies focus on their key technologies and adjust to the realities of the COVID-19 pandemic:

Snigdha Parida, analyst for Thematic Research at GlobalData, commented: “The most lucrative themes driving M&As in 2020 were connectivity, big data, cloud, fintech, digital media, gaming, the internet of things (IoT), healthtech, the future of work and ecommerce. The report identifies the overall themes that drove M&A in TMT. It also categorizes all major deals announced between 2016 and 2020 into their respective sectors, with details of the themes driving each deal.

Scope

- This report provides an overview of merger and acquisition activity in the global TMT market in 2020 and assesses the impact of COVID-19 on M&A activity.

- It identifies the M&A deals announced in the TMT market between 1 January 2016 and 31 December 2020 and provides comprehensive sector-by-sector analysis of the themes driving this activity.

Key Highlights

- Despite the global pandemic, total M&A activity in the global technology, media, and telecom (TMT) sector reached $903bn in 2020, up 25% on 2019. The total number of deals in 2020 reached 702, but most activity occurred in the second half of the year.

- Q2 2020 saw just 103 M&A deals in the TMT sector, the lowest quarterly deal count in the last five years. The number of deals climbed to 230 in Q3 and 222 in Q4, making the second half of 2020 the highest in terms of both deal count and deal value in the last five years.

Reasons to buy

This report offers a unique perspective on M&A activity in the TMT sector by focusing on the themes driving deals. This allows for a deeper understanding of the themes that are shaping the industry. In addition, it provides fresh insight into the impact of the COVID-19 pandemic on M&As, including analysis of proposed deals that have been postponed due to the pandemic.

Companies mentioned

3D Systems

ABB

Abbott

Acacia

Accenture

Activision Blizzard

Acxiom

Adidas

Adobe

ADT

Advantage Solutions

Aeva

Afimilk

Alarm.com

Alibaba

Alphatec

Alteryx

Amazon

Ambarella

AMC Networks

AMD

America Movil

AMS

Anixter International

Ant Group

Apple

Aptiv

Arrival

ASOS

AT&T

Atos

Atresmedia

Autodesk

Automation Anywhere

Automation-Edge

Axel Springer

B2W Cia Digital

BAE Systems

Baidu

Banks

Bloomberg

Blue Prism

Boohoo.com

Booking Holdings

Bosch

Box

Broadcom

Cambricon

Canon

CAR

Carmakers

Cassa Depositi e Prestiti (owns 10% stake)

CBS

CD Projekt

CGI

ChannelAdvisor

Check Point Software

Chegg

Ciena

Cinedigm

Cisco

Citrix Systems

Clayton, Dubilier & Rice

Cloudera

Codemasters

Cognex

Cognizant

Comcast

ComScore

Comtech

Consumer goods companies

Continental

Cornerstone OnDemand

CoStar

Coursera

Criteo

Dassault Systèmes

Delivery Hero

Dell

Denso

Dentsu

Desjardins Group

Dish Network

Disney

DJI

Domo

DoorDash

Dropbox

D-Wave Systems

Dyson

E2Open

eBay

EHang

Electronic Arts

eNett

Enova

Entertainment companies

Enthusiast Gaming

EOS imaging

EPAM Systems

Epic Games

Equity firms

Ericsson

Euromoney

Expedia

EY

Facebook

Fang Holdings

Fanuc

FireEye

Fisker

Fitbit

Flutter Entertainment

Forrester Research

Fortinet

Future Today

Garmin

Gartner

GE

GE Digital

Genpact

Gilat Satellite

Glu mobile

GoDaddy

Google

GoPro

Graf Industrial

Graphcore

Groupon

Grubhub

Harmonic Drive

Havas

HCL

HelloFresh

Hikvision

Hilton worldwide

Honda

Honeywell

HP

HPE

HTC

Huawei

IAC Interactive

IBM

Indra Sistemas

Infineon

Infinera

Informa

Infosys

Intel

Interpublic

Intuit

Intuitive Surgical

iRobot

ITV

JCDecaux

JD.com

John Deere

Johnson & Johnson

Juniper Networks

JustEat

Kakaku

Keyence

Klarna

KPMG

Largan Precision

Lemonade

LendingClub

LendingTree

Lenovo

LG Electronics

Lions Gate Entertainment

Livestock Improvement

Lockheed Martin

Luminar Technologies